Dutchbangla Bank SWIFT Code Ensures Secure Global Transfers

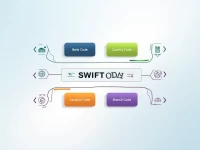

This article introduces the SWIFT/BIC code DBBLBDDH101 of DUTCH-BANGLA BANK PLC, highlighting its significance in international remittances. It provides essential information to consider when using this code, ensuring the safety and accurate transfer of funds.